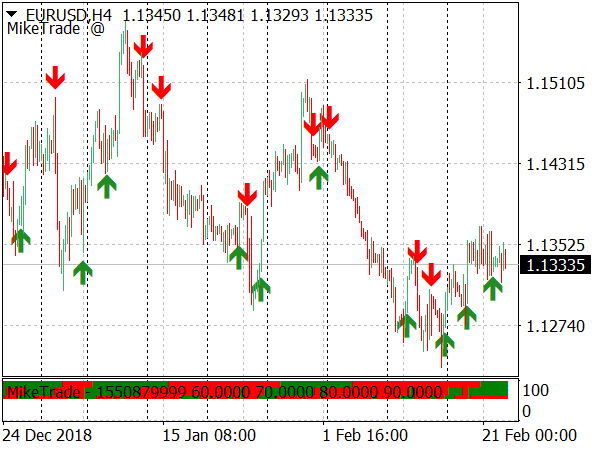

10/02/ · For me, the only oscillator I use is the stochastic! I've found the 80/20 values to be excellent for determining if the market is oversold/overbought. This method works much better in the longer timeframes, as ones such as the MM1 are far too "noisy" 11/06/ · Average rating: 1 reviews. Jun 11, by Andre J McClendon on blogger.com Do not use this indicator, this indicator repaints and does not keep indicator values properly. If you use this indicator you will have extreme difficulty trading so i wouldn't.1/5(1) 25/03/ · The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions. more Stochastic Oscillator

Indicators for Overbought and Oversold Stocks

In general, momentum oscillators with a fixed range are best suited for identifying overbought and oversold conditions. These include RSI, the Stochastic Oscillator and StochRSI. RSI and the Stochastic Oscillator fluctuate between zero and one hundred, while StochRSI fluctuates between zero and one.

Momentum oscillators like MACD and the Percentage Price Oscillator PPO do not have fixed ranges and this makes it more difficult to identify overbought and oversold conditions. The QQQ chart below shows RSI 10the Slow Stochastic Oscillator 14StochRSI 14 and MACD, which is just shown for reference. First, notice that RSI is the least sensitive of the three fixed-range oscillators because there were only two oversold readings in seven months.

I best forex oscillator for over bought and over sold shortened the look-back period from 14 to 10 in order to increase sensitivity. Second, notice that an oscillator can become overbought and remain overbought in a strong uptrend, best forex oscillator for over bought and over sold. The Stochastic Oscillator moved above 80 on October 24th and remained above 80 until December 3rd. Third, notice that StochRSI is by far the most sensitive of the three.

This is because StochRSI is an indicator of an indicator. There are two things chartists should keep in mind. First, look for oversold readings when the bigger trend is up and overbought readings when the bigger trend is down. An oversold reading in an uptrend signals a pullback. Second, set a trigger to signal an end to overbought or oversold conditions.

Each oscillator has a centerline that can be used for such a signal. For example, a move below. This condition ends when StochRSI surges above.

In order to use StockCharts. com successfully, you must enable JavaScript in your browser. Click Here to learn how to enable JavaScript. Click here to see the live version Click here to see the live version. About the author: Arthur HillCMT, is a Senior Technical Analyst at StockCharts. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed technician, best forex oscillator for over bought and over sold.

In addition to his CMT designation, Arthur holds an MBA from the Cass Business School at City University in London. Learn More. Previous Article. Next Article. Subscribe to MailBag to be notified whenever a new post is added to this blog! Attention: your browser does not have JavaScript enabled!

How To REALLY Use Overbought And Oversold Indicators

, time: 6:25

11/06/ · Average rating: 1 reviews. Jun 11, by Andre J McClendon on blogger.com Do not use this indicator, this indicator repaints and does not keep indicator values properly. If you use this indicator you will have extreme difficulty trading so i wouldn't.1/5(1) 10/02/ · For me, the only oscillator I use is the stochastic! I've found the 80/20 values to be excellent for determining if the market is oversold/overbought. This method works much better in the longer timeframes, as ones such as the MM1 are far too "noisy" 23/09/ · There are a few things to look for when looking for the main indicators for oversold and overbought stock or forex pair. Programs such as MT4 offer highly effective and robust trading on the most common methods for forex trading and a thorough definition of both blogger.comted Reading Time: 9 mins

No comments:

Post a Comment