29/08/ · Forex Price Action Scalping Pdf Volman. Best Forex Trading Tips Images In Investing Success Forex Education Dailyfx Free Online Trading University! Learn Forex Trading Free Faceless Trader Tales Of How A Faceless Trader Sought To Become An most circumstances, for the value date and the trade date to be the same. The forward value date is usually required to allow both parties time to arrange for payments which often occur in different time zones. By market convention, foreign exchange trades settle two mutual business days (T + 2) after that trade date unless otherwise specified 16/09/ · DailyFX is the leading portal for financial market news covering forex, commodities, and indices. Discover our charts, forecasts, analysis and more

Forex University Courtesy Of Dailyfx - Forex Price Action Scalping Pdf Volman

edu no longer supports Internet Explorer. To browse Academia. edu and the wider internet faster and more securely, dailyfx forex trading university pdf, please take a few seconds to upgrade your browser. Log In with Facebook Log In with Google Sign Up with Apple. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account?

Click here to sign up. Download Free PDF. Akonnor Owusu Larbi. Download Dailyfx forex trading university pdf Download Full PDF Package This paper. A short summary of this paper. Contact us by email to akonnor93 gmail. NO MIDDLEMEN NO FIXED LOT SIZE HIGH LIQUIDITY LOW BARRIERS TO ENTRY DEMO PLATFORMS The foreign exchange market is largely made up of institutional investors, corporates, governments, banks, as well as currency speculators.

Unlike the stock market and future markets that are housed in dailyfx forex trading university pdf physical exchanges, the foreign exchange market is an over0 the counter market, decentralized market completely housed electronically. Though investors are familiar with the stock market they are unaware how small in volume it is in relation to the Forex Market. This liquidity makes it easy for traders to sell and buy currencies. This is the reason why traders from all over the world are turning to the FX Market.

This means that there is no one single Forex market, dailyfx forex trading university pdf, like in stock trading and local exchanges for example.

Below is a few reasons why so many people are choosing this market: 1. No commissions No clearing fees, no exchange fees, no government fees, no brokerage fees. No middlemen Spot currency trading eliminates the middlemen and allows you to trade directly with the market responsible for the pricing on a particular currency pair. No fixed lot size In the futures markets, lot or contract sizes are determined by the exchanges. A standard size contract for silver futures is 5, ounces.

In spot forex, you determine your own lot, or position size. For larger transactions, the spread could be as low as 0. Of course, this depends on your leverage and all will be explained later in this trading course with Akonnor Owusu Larbi. A hour market There is no waiting for the opening bell. From the Sunday evening PM GMT to Friday Evening PM GMT, the forex market never sleeps. This is awesome for those who want to trade on a part-time basis because you can choose when you want to trade: morning, noon, night, during breakfast, or in your sleep.

This being said, Fundamentals do play a role in volatility. Fundamentals will be explained later. Leverage In forex trading, a small deposit can control a much larger total contract value. Leverage gives the trader the ability to make nice profits, and at the same time keep risk capital to a minimum.

Without proper risk management, this high degree of leverage can lead to large losses as well as gains. High Liquidity Because the forex market is very large in size, it is also extremely liquid. This is an advantage because it means that under normal market conditions, with a click of a mouse you can instantaneously buy and sell at will as there will usually be someone in the market willing to take the other side of your trade. Low Barriers to Entry You would think that getting started as a currency trader would cost a ton of money.

These services are all free. In simple terms, one can buy and sell currency pairs. The first currency in a currency pair is the base currency and the second one the quote currency. When the trading sessions overlap, you usually have the highest trading activity. The time is in Greenwich Mean Time. GMT is the mean solar time at the Royal Observatory in Greenwich, London, reckoned from midnight.

Often times, dailyfx forex trading university pdf, trading platforms will come bundled with other features, such as real-time quotes, charting tools, news feeds, and even premium research.

Platforms may also be specifically tailored to specific markets, such as stocks, currencies, options, or futures markets.

They are many Trading platforms. These include: MetaTrader 4 - MetaTrader 4 is a platform for trading Forex, analyzing financial markets and using Expert Advisors. Mobile trading, Trading Signals and the Market are the integral parts of MetaTrader 4 that enhance your Forex trading experience.

Interactive Brokers - Interactive Brokers is the most popular trading platform for professionals with low fees and access to markets around the world. TradeStation - TradeStation is a popular trading platform for algorithmic traders that prefer to execute trading strategies using automated scripts developed with Easy Language.

TDAmeritrade - TDAmeritrade is a popular broker for both traders and investors, especially following its acqusition of ThinkorSwim and the development of the Trade Architect platforms. It is simple enough for beginners to start trading with MT4, as their first platform, but its advanced funcionalities such as dozens of built-in indicators, graphical tools, the dailyfx forex trading university pdf to run trading robots, EAs make it perfect for intermediate or even advanced traders.

The first step is to get MetaTrader 4 downloaded onto your dailyfx forex trading university pdf or laptop. Follow your Computer's Prompt. Tick the Licence Agreement Box. Click Finish. Open an Account. Input your Details. Save your Login and Password. After installing Metatrader4 on your computer or any gadget, the graphics in the terminal are displayed in a standard way.

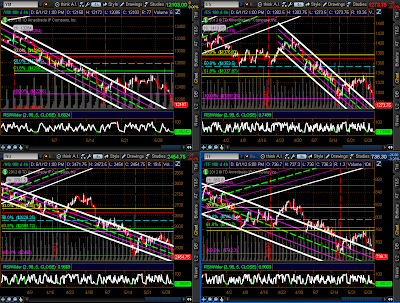

But all traders visually absorb information in different ways, that's why MT4 provides the ability to change the options of charts to display them in accordance to your desires. Standard settings are not suitable for analyzing the price movements for many traders, so if you want to change something, you can reorganize the scale, period, and the color of charts.

In general, MT4 provides many functions for modifying graphs, dailyfx forex trading university pdf, and below we will tell about it in details. A key way to win in Forex Market is how to analyse your charts. Contact me with Gmail- akonnor93 gmail. com to learn my secret to winning. Open the window "market watch", click the right mouse button on the desired currency pair and choose the menu item "Chart Window". On the toolbar, click the buttonthen select a group of trading instruments from the drop down list.

Follow the path: "Window" — "New window", then repeat step 2. Follow the path: "File" - "New schedule", then repeat step 2. Please note: only characters opened in the window "market watch" will be displayed in the list of trading instruments. To display all symbols, press the right mouse button on any field of the window "market watch" and click on the row "Show all symbols".

Zoom allows you to focus on the details while reducing the figure gives an opportunity to look at the General trend. In MT4, you can use several ways to change the chart scale: 2. On the toolbar ; 5. Anywhere in the active window open the context menu by pressing the right mouse button and then refer to the command "Increase" or "Decrease". However, for assessing the General trend you need a wide timeframe.

Clicking on "Graphics" in the main menu bar you can choose the visualization of the line chart, bar chart, and the Japanese candlestick chart. The same function is available in the toolbarL: just click on the corresponding icon. In the next window, you can define the color of each element of your schedule in the tab "Colors", dailyfx forex trading university pdf. In the "Color scheme", dailyfx forex trading university pdf, you can select the yellow graphics on a black background, it is also possible to choose green on a black background, and for conservative traders there is a black-and-white palette.

In addition to autocomplete in the right box you can choose the color of each element separately 1. This eliminates the need to adjust every time the visualization window. With one click You can dailyfx forex trading university pdf a favorite solution that will allow You to analyze the price movement quickly. For activating a saved template, dailyfx forex trading university pdf, click on the buttonthen on "Load template".

Once you find the desired version of the template, click "Open" and the graph will be shown in the right way. You can remove a template by a similar way, choosing the line "Remove template". With all these, you can equally trade on your mobile phone by downloading MT4 from Plat Store or Apple Shop. There are market orders to buy and market orders to sell.

A market order gives you whatever price is available in the marketplace. The order is only filled at or above the limit price.

The order is only filled at or above the stop price. The order will only be filled at or below the stop price.

How To Trade the News

, time: 36:25Forex for Beginners: An Introduction to Forex Trading

Learn how to become a consistent forex trader with advice from DailyFX analysts. 3 3 Things I Wish I Knew When I Started Trading Forex. One trader entered FX to make lots of money, but quickly Forex trading for beginners pdf. According to the Bank of International Settlements, foreign exchange trading increased to an average of $ trillion a day. To simply break this down, the average has to be $ billion per an hour. The foreign most circumstances, for the value date and the trade date to be the same. The forward value date is usually required to allow both parties time to arrange for payments which often occur in different time zones. By market convention, foreign exchange trades settle two mutual business days (T + 2) after that trade date unless otherwise specified

No comments:

Post a Comment