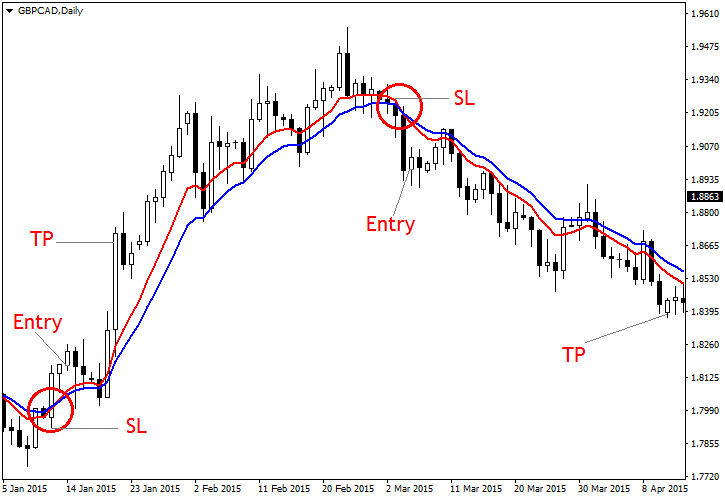

As you can see, this is a simple moving average trading strategy that takes into account trend and momentum for your trading signals. Ensure you use proper stop losses, risk control, and you find ways to take what the market is offering without kneejerking out of your blogger.comted Reading Time: 5 mins The SMA was designed to smooth out the effects of price volatility and create a clearer picture of changing price trends. Traders use an SMA, sometimes in concert with another SMA for a different period, to signal confirmation of a change in price behavior. The benefit of the SMA indicator is its visual simplicity 30/06/ · The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. It can be utilized with a trend change in either direction (up or down)

Moving Average Strategies for Forex Trading

Just about any simple moving average trading strategy needs a good trending market to be an effective trading strategy. Once a trading chart starts showing consolidating price action, the moving averages become virtually useless although moving averages converging can help you objectively identify a market in chop.

There are trading strategies that take advantage of consolidations and those are either trading the range or using a breakout trading strategy.

Understanding various forex simple moving average strategy of technical analysis to identify favorable range trading conditions are something traders should learn so they are not caught up trading consolidations when they think they are trading a trending market. This moving average trading strategy is going to focus on trading pullbacks in a trending market and we will combine it with measures of:.

You can use this trading strategy in Forex or other markets and as either a day trading approach, swing trading, and even position trading. In reality, the differences between various forms of moving averages will not improve a trading strategy to any measurable result.

We are using simple moving averages as a matter of course and by using the SMA, we will just be using the last X days average of price. Exponential moving averages takes into account more data than the period used although the impact of historical price data decays over time.

Time frames — You can forex simple moving average strategy lower time frames such as 5 minute charts higher time frames 4 hours — daily chart are my favorite time frames for trading Forex. Currency — Any currency pair but stick to the currency pairs that move such as EURJPY, Forex simple moving average strategy, GBPUSD.

Indicators — 5 and 10 simple moving averages SMAstochastic oscillator 14,3,3, and RSI setting of 9, forex simple moving average strategy.

RSI relative strength index — Measure of trend strength. The 5 SMA is a fast moving average and we will combine it with the slightly slower 10 period SMA. When the 5 crosses the 10 to the upside, we will assume we are in an uptrend. When the 5 crosses to the downside over the 10 simple moving average, assume we are in a down trend. This is a nice objective way to measure the trend although using any technical indicator, you will have a lag between the price action and the indicator showing the trend change.

As with any trading strategy, you must follow the rules or you will not find much success. Even better, make sure you put together a trading plan that dictates every move you will make in the markets.

That is how you will determine a short trade and before you trade the sell signal, forex simple moving average strategy, ensure you know where you will get out if wrong. We will cover stop loss positions later, forex simple moving average strategy. The candlestick shown as the setup candlestick may NOT be the one that actually turned the moving averages. Remember, moving averages are lagging indicators and it may forex simple moving average strategy been the next one that showed the clear turn.

The only difference between a sell signal and a buy signal is the direction the indicators must show. I am not a believer in a set number of pips for a stop loss. You have various techniques you can use for a protective stop loss:. Whichever method you use, the key is to be consistent with all your trading setups. This is why you need a trading plan to ensure you stay on the right track. You can read this article, Let Profits Runto see how to take full advantage of what the market is offering instead of taking only a few pips from the move.

Some traders will target various support or resistance levels to exit their trade. Here is a support and resistance indicator for Metatrader you can download. I must say that one of my favorite ways of finding profit targets for any strategy including a moving average trading strategy is Fibonacci extentions. I may do an article on how to use Fibonacci in terms of taking profits.

I find it incredibly useful as the various levels also act as areas to scale out partial profits. As you can see, this is a simple moving average trading strategy that takes into account trend and momentum for your trading signals, forex simple moving average strategy. Ensure you use proper stop losses, risk control, and you find ways to take what the market is offering without kneejerking out of your trades.

This moving average trading strategy is going to focus on trading pullbacks in a trending market and we will combine it with measures of: The strength of the trend we are trading If price is either oversold or overbought You can use this trading strategy in Forex or other markets and as either a day trading approach, swing forex simple moving average strategy, and even position trading.

Difference Between Simple Moving Averages And Others In reality, the differences between various forms of moving averages will not improve a trading strategy to any measurable result. When the 5 crosses the 10 to the upside, we will assume we are in an uptrend When the 5 crosses to the downside over the 10 simple moving average, assume we are in a down trend. RELATED Daily Chart Forex Trading Strategy for Non Day Traders.

RELATED 5EMA And 8EMA Forex Trading Strategy. Prev Article Next Article.

How to Trade With Moving Averages - (Part 1)

, time: 11:41

30/06/ · The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. It can be utilized with a trend change in either direction (up or down) As you can see, this is a simple moving average trading strategy that takes into account trend and momentum for your trading signals. Ensure you use proper stop losses, risk control, and you find ways to take what the market is offering without kneejerking out of your blogger.comted Reading Time: 5 mins The SMA was designed to smooth out the effects of price volatility and create a clearer picture of changing price trends. Traders use an SMA, sometimes in concert with another SMA for a different period, to signal confirmation of a change in price behavior. The benefit of the SMA indicator is its visual simplicity

No comments:

Post a Comment