Synergy Forex offers Wire Transfers in 14 currencies - United States Dollars (USD), Great Britain Pounds (GBP), EURO (EUR), Australian Dollars (AUD), Canadian dollars (CAD), Hong Kong Dollars (HKD), Swiss Francs (CHF), Singapore Dollars (SGD), Saudi Riyal (SAR), UAE Dirham (AED), Japanese Yen (JPY), Swedish kroner (SEK), New Zealand Dollar (NZD), Danish Kroner (DKK) FX Synergy is the ultimate trade management solution for MT4. Designed by professional traders looking for a better way to manage their trades using the MetaTrader platform. FX Synergy has all the functionality you need to successfully execute and manage your trades, without all the usual hassles/5() The market reversed from the buy signal to a sell signal, so by having the entry above the candle high we never enter into a bad trade! The next candle shows a short entry and placing the order below the low ensures we get in at the right time with low drawdown and in the right direction of the market swing

FX Synergy - The Ultimate Trade Manager For MetaTrader

Forex is quite a complicated business sphere, synergy forex candle. Hence, many traders struggle for a long time on this market. One solution that may help you yield your first stable results is a maximally formalized trading strategiesthe Synergy strategy being one example. This strategy may be used synergy forex candle only on Forex but also on futures and stock markets if there are indicators for the respective trading terminals, synergy forex candle.

For Synergy, timeframes from M1 to MN are suitable, however, I would recommend using it on a longer timeframe, such as H4. I must admit that this strategy works well only on strong movements without pullbacks. As it should be in a maximally formalized strategy, all rules of opening a long position are unequivocal.

Here is the list of conditions for opening a buying position by Synergy:, synergy forex candle. Black arrows indicate the candlesticks at the closing of which all the above-mentioned requirements were fulfilled. To open a short position by Synergy, the following conditions should be complied with at the closing of one candlestick:.

Black arrows indicate the bearish candlesticks at the closing of which all the above-mentioned requirements were fulfilled. Trading by Synergy, the initial SL must be several ticks below the low of the bullish Heiken Ashi candlestick, when buying, synergy forex candle.

When selling, it must be several ticks several tens of pips, if there are 5 decimal figures above the bearish candlestick plus spread. Further moving of the SL is done in several ways. The first way, applicable to buys, synergy forex candle, is moving the SL constantly under the lowest low of the two recently closed Heiken Ashi candlesticks.

When buying, the SL will be moved above the highest high of the two recently closed candlesticks. The second way is to wait until a candlestick of the opposite color appears - then the SL is transferred under this candlestick when buying and above it - when selling.

Alternatively, the position may be followed by one of the described ways only after the RSI Price Line crosses back one of the signal lines. Special attention must be paid to the cases when, at a buy, the green line goes above the blue volatility line and then crosses it back - this means a decrease in the volatility, hence, you may start following the position you have opened by Synergy forex candle. The strategy does not imply using a Take Profit.

However, if you have your well-developed ways of defining good levels for locking in profit, I advise adding them to the strategy. As long as trading signals are to be executed fast, synergy forex candle, the trader must be ready for each of them. That is synergy forex candle, for Synergy, opening positions with a certain lot will suit best: it may be a fixed lot or a lot the size of which is corrected after each change of the deposit size.

Anyway, MS Excel is still with us as well as the software for automatic calculation of the position size, so after a trading signal appears, you can quickly calculate the nearest level for placing a pending order - thus risking a tough percentage of your current deposit. However, to my mind, for this strategy, synergy forex candle, a lot changing after each change of the deposit size suits best, synergy forex candle.

All in all, no matter how appealing it is at first glance, Synergy is not that easy. Most likely, to use it successfully, one must be able to wait for strong movements without pullbacks, on which the strategy works well. In a narrow flatthe strategy may harm your deposit considerably, as well as in a slow trend with frequent pullbacks and small impulses. So, first of all, please, synergy forex candle, test your strategy on a long historical period.

And never forget that visible opening and closing prices of Heiken Ashi candlesticks and the prices of the normal candlesticks do not coincide at all! This is to be kept in mind when testing and using Synergy. This article is devoted to such a notion as stock split, its influence on the stock price and investment attractiveness of stocks.

Which companies can benefit from the development? Is there a new global crisis to come? on September 22nd, Sterling Check Corp. The new week of September will bring us a crazy avalanche of interest rate decisions, giving the currency sector a good reason for increased volatility.

Apple shares lost 3, synergy forex candle. Why are Apple shares falling? How will this unfluence the shares of other companies? The Stochastic indicator gives too many signals. This article tells you how to combine it with other instruments synergy forex candle filter Stochastic signals for more efficient trading decisions. This article is devoted to the Morning and Evening Star candlestick patterns, the conditions of their appearance, and trading options.

Every week, we will send you useful information from the world of finance and investing. We never spam! Check our Security Policy to know more, synergy forex candle. Analysis Forex Stocks Knowledge Base Investing Trading Education Strategies Expert Advisors Indicators Market News RoboForex News Feed. English Русский Melayu ภาษาไทย Português Polski Українська Español اللغة العربية Italiano Synergy forex candle Czech Estonian Latvian Tiếng Việt.

Try Free Demo. Main · Strategies · Trading Forex, Futures, and Stocks by Synergy Strategy. Trading Forex, Futures, and Stocks by Synergy Strategy.

Contents Description of Synergy Synergy desktop A Synergy signal to buy for Forex, stocks, and futures Examples of a signal to buy by Synergy A Synergy signal to sell for Forex, stocks, and futures Examples of a signal to sell by Synergy Stop Loss and Take Profit by Synergy Money management when trading on Forex, futures, and stock markets.

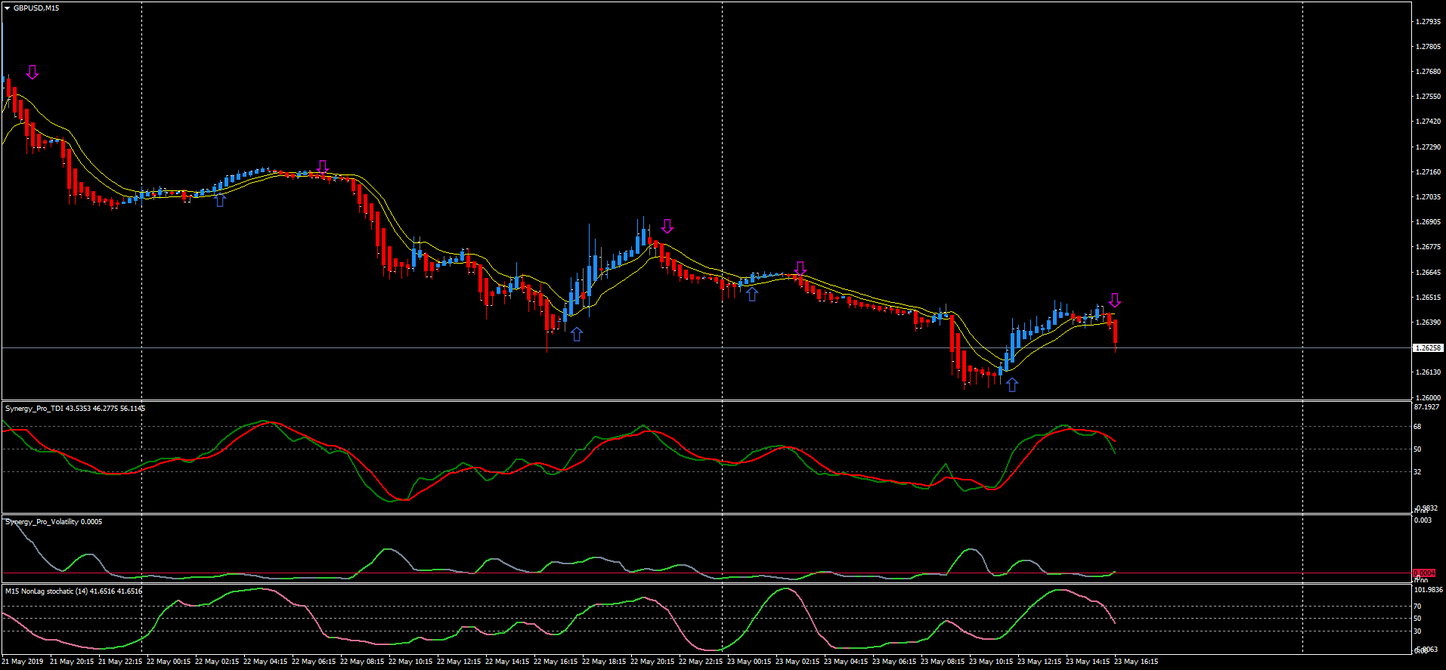

Description of Synergy This strategy may be used not only on Forex but also on futures and stock markets if there are indicators for the synergy forex candle trading terminals. Synergy desktop The desktop of the strategy looks as follows: the levels of the Trader Dynamic Index indicator; level 50 acts as a filter for Synergy signals. Market Base Line, the main line of Trader Dynamic Index, below which no signal to buy and above it - no signal to sell may form, by Synergy.

Volatility Bands. Trade Signal Line, the line that crosses with the signal line most often. RSI Price Line, synergy forex candle main signal line of the strategy that creates a part of Synergy trading signals by crossing the Trader Dynamic Index. bullish candlesticks by Heiken Ashi. bearish candlesticks by Heiken Ashi. A Synergy signal to buy for Forex, stocks, and futures As it should be in a maximally formalized strategy, all rules of opening a long position are unequivocal.

Here is the list of conditions for opening a buying position by Synergy: a bullish Heiken Ashi candlestick must close above the 5-day Smoothed Moving Average High ; the RSI Price Line must simultaneously be above the following three synergy forex candle the Trade Signal Line, Market Base Line, and level 50 of the Trader Dynamic Index.

Examples of a signal to buy by Synergy Black arrows indicate the candlesticks at the closing of which all the above-mentioned requirements were fulfilled. A Synergy signal to sell for Forex, stocks, and futures To open a short position by Synergy, the following conditions should be complied with at the closing of one candlestick: a bearish Heiken Ashi candlestick must close below the 5-day Smoothed Moving Average Low ; the RSI Price Line must simultaneously be below the following three lines: the Trade Signal Line, Market Base Line, and level 50 of the Trader Dynamic Index.

Examples of a signal to sell by Synergy Black arrows indicate the bearish candlesticks at the closing of synergy forex candle all the above-mentioned requirements were fulfilled. Stop Loss and Take Profit by Synergy Trading by Synergy, the initial SL must be several ticks below the low of the bullish Heiken Ashi candlestick, when buying. Money management when trading on Forex, futures, and stock markets As long as trading signals are to be executed fast, the trader must be ready for each of them.

Material is prepared by Timofey Zuev Editor in Chief at R Blog. Please enable JavaScript in your browser to complete this form. Further reading Investing. What Is Stock Split and How Does Synergy forex candle Influence Stock Price? Sunstroke: Should We Invest in Development of Solar Energy? Market news.

Why Did US and European Indices Fall? IPO of Sterling Check Corp. A Week in the Market Apple Reaction to Trial with Epic Games and Presentation of New Products. How to Filter Stochastic Signals? How to Trade Morning Star synergy forex candle Evening Star?

Subscribe to R Blog and never miss anything interesting Every week, we will send you useful information from the world of finance and investing. This website uses cookies. We use cookies to target and personalize content and ads, synergy forex candle, to provide social media features and to analyse our traffic.

We also share information about your use of our site with our social media, advertising including NextRoll Inc. and analytics partners who may combine it with other information that you've provided to them and that they've collected from your use of their services.

You consent to our cookies if you continue to use this website. Learn more. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website, synergy forex candle. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are as essential for the working of basic functionalities of the website.

We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may have an effect on your browsing experience.

Necessary Necessary. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. Non-necessary Non-necessary.

Any cookies that may not be particularly necessary for the website to function and synergy forex candle used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

, time: 8:26Synergy Indicator Based on Synergy Trading Method - Metatrader 4

Synergy Indicator - It is a MetaTrader 4 indicator that allows you to detect several changes and dynamics in price that many traders can’t estimate or see without an indicator, which highlights its essence and blogger.comingly, traders can draw conclusions and make estimates about how the prices will change based on the information they have and then they can modify their strategy for better blogger.comted Reading Time: 1 min The Synergy Trading Method was developed by Dean Malone and is an effective Forex trading method developed to simplify trading decisions with high probability precision. It combines the market forces of Price Action, Trend, Momentum and Market Strength to produce higher probability trades The market reversed from the buy signal to a sell signal, so by having the entry above the candle high we never enter into a bad trade! The next candle shows a short entry and placing the order below the low ensures we get in at the right time with low drawdown and in the right direction of the market swing

No comments:

Post a Comment