10/05/ · The next important aspect to consider in the Forex vs stock trading debate is liquidity. The Forex market is extremely liquid. This is a result of the vast number of participants involved in trading at any given time. If you are trading stocks, you will notice that large, popular stocks can also be very blogger.comted Reading Time: 7 mins 27/05/ · Forex vs. Stock Trading: which should you trade? The answer to this question completely depends on your goals as a trader, your trading style, and how much risk you can take. If you talk about the forex market, it offers you far more leverage and fewer regulations than stock trading 10/11/ · Should You Choose Forex or Stocks For Day Trading? The answer is obvious, you should pick Forex because it is a lot more advantageous for a short-term oriented day trader Estimated Reading Time: 5 mins

Forex vs Stocks: Which Is Better For Day Trading? - My Trading Skills

Apr 2, Day Tradingforex or stock trading, Stock MarketForex or stock trading Strategy. Understanding the differences between forex and stock trading can help you to decide whether one type of trading may be more suitable to your goals and style as a trader than the other.

Stock trading involves buying and selling shares of individual companies, whereas forex trading involves exchanging — buying and selling simultaneously — cash minted by two different countries.

This means that the mechanisms underlying these two forms of trading are very different and can be advantageous under different situations.

Stock trading is best when markets are rising, since forex or stock trading liquidity makes it difficult to short sell in falling markets.

Forex trading, on the other hand, can be lucrative in any scenario since every trade involves both buying and selling and liquidity is high. Although forex and stock trading are marked mostly by their differences, they do share some characteristics in common, forex or stock trading.

Both forex and stock trading involve taking advantage of short-term shifts in prices to generate profit, and in the process entail risk that the stock or currency you are holding will fall-HANNA in value from the purchase price rather than rise. In addition, much like stock trading, forex traders rely heavily on technical analysis in order to identify probably price movements and inform trading behavior.

Finally, trading both forex and stocks requires a strong fundamental understanding of how markets work and practice in order to turn a consistent profit. One of the obvious differences between stock trading and forex trading is that they are regulated by different agencies within the US. Whereas the Securities and Exchange forex or stock trading all equities and stock options trading, forex trading comes forex or stock trading the purview of the Commodities Futures Trading Commission — a government agency — and the non-profit National Futures Association.

One of the main goals of these regulatory is are to protect individual traders and investors from fraudulent brokers, which are abundant in the forex markets of less heavily regulated countries.

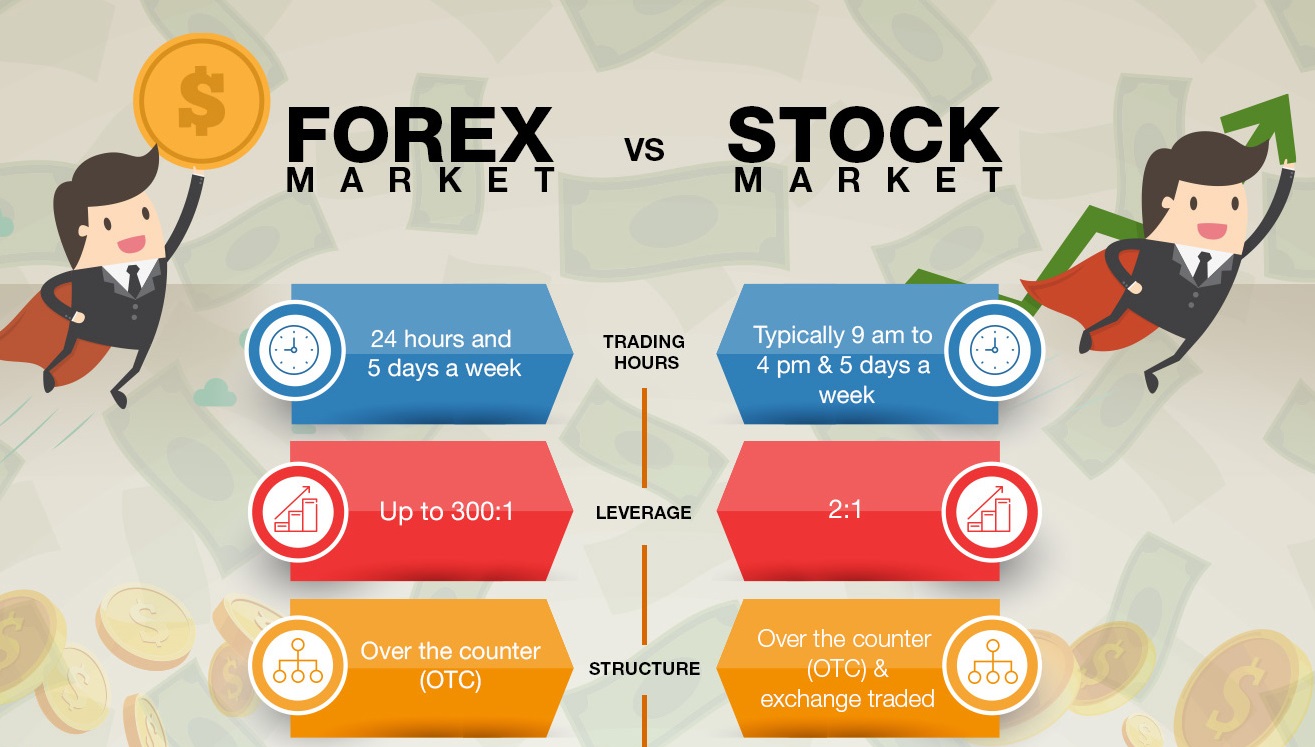

The amount of leverage available in forex trading is overwhelming compared to that in stock trading, which can make forex trading both incredibly lucrative and also incredibly risky.

Forex trading is conducted 24 hours a day, in contrast to stock trading that operates on a much more limited timeframe and only during weekdays. Part of the reason for this is that forex trading does not rely on any central exchange with a physical location, but rather occurs globally over electronic communications networks. It is also critical for global trade that forex trading take place 24 hours a day since foreign currencies are in constant demand around the world. Stocks and other securities are not typically in demand enough after business hours in the country in which the companies underlying those stock reside, making it difficult to justify keeping the market open past business hours.

In general, the stock market tends to be more volatile than the forex market since currencies tend to be relatively stable in price with respect to one another when economic conditions are steady. However, forex or stock trading, this is not always the case, forex or stock trading, and forex trading has a reputation for periods of extreme volatility — which may or may not coincide with periods of extreme volatility in national stock markets.

While stocks may be traded globally, the market for equities is largely national rather than international. Forex, on the other hand, operates on a global market. This is aided by the fact that forex trading occurs 24 hours a day, so that it is possible for forex traders to trader across any currency depending on the time of day and what brokers are active, forex or stock trading.

On the forex or stock trading hand, while there are typically thousands of stocks to choose from on a single exchange, forex trading revolves largely around 18 pairs of currencies that have particularly high liquidity. Compared to stocks, forex is highly and consistently liquid. The reason for this is that stocks are limited in supply to a greater or lesser extent since they represent shares of a company. Blue chip stocks typically have many shares available and thus have high liquidity, forex or stock trading, while penny stocks typically have a low number of available shares and thus have low liquidity.

On the other hand, while currencies are finite in supply, they are essentially infinite for the purposes of trading under normal economic conditions. The types of news that influences the prices of forex and stocks also differ somewhat. Forex prices are forex or stock trading shifted by global news, whereas stock prices are most often responding to news about the company underlying the stock or its respective sector.

Both forex and stock prices may respond to news about large-scale shifts in economic conditions within a country or to political news that traders believe will have an impact on the economy in the near future. Whether stock trading or forex trading is better for you largely depends on your goals as a trader, on your trading style, and forex or stock trading your tolerance for risk. Forex trading involves far more leverage and far less regulation than stock trading, which makes it both highly lucrative and highly risky.

On the other hand, tracking forex or stock trading market is often easier than tracking stock markets since there are only 18 common pairs of currencies to trade rather than thousands of potential stocks.

One unusual drawback to forex trading compared to stock trading is that it takes place 24 hours a day, which means that you may need to be working at odd hours to realize certain trades and that the market is still changing whenever you are not working. Ultimately, forex or stock trading, practicing both forex trading and stock trading to find which form of trading fits you better is the best way to choose between them.

Forex and stock trading are highly divergent forms of trading based on short-term price action. Forex and stock trading differ in terms of the regulations surrounding trades, forex or stock trading, the size of the markets and hours of trading, the liquidity and volatility of prices, and even the types of news that prices respond to.

Understanding both forex and stock trading can help you determine which type of trading better fits your goals and trading style. Account Login ActiveWeb Axos Activeweb ApexPro AXOS Clearing ApexPro Clearing. Stock Trading vs. Forex Trading Apr 2, Day TradingStock MarketTrading Strategy.

Stock Trading and Forex Trading Stock trading involves buying and selling shares of individual companies, whereas forex trading involves exchanging — buying and selling simultaneously — cash minted by two different countries. Similarities between Forex and Stocks Although forex and stock trading are marked mostly by their differences, they do share some characteristics in common.

Differences between Forex and Stocks Regulation One of the obvious differences between stock trading and forex trading is that they are regulated by different agencies within the US. Leverage The amount of leverage available in forex trading is overwhelming compared to that in stock trading, which can make forex trading both incredibly lucrative and also incredibly risky.

Trading Hours Forex trading is conducted 24 hours a day, in contrast to stock trading that operates on a much more limited timeframe and only during weekdays. Volatility In general, the stock market tends to be more volatile than the forex market since currencies tend to be relatively stable in price with respect to one another when economic conditions are steady.

Market Size While stocks may be traded globally, the market for equities is largely national rather than international. Liquidity Compared to stocks, forex is highly and consistently liquid, forex or stock trading.

Catalysts and Price Influencers The types of news that influences the prices of forex and stocks also differ somewhat. Which is Better for You? Conclusion Forex and stock trading are highly divergent forms of trading based on short-term price action, forex or stock trading.

Ready to open an Account? GET STARTED. Check Our Daily Updated Short List GET STARTED. Estimate Your Commission Savings at SpeedTrader GET STARTED. Recent Posts A History of Stock Market Crashes — What You Need To Know How Do the Stock and Bond Markets Affect Each Other?

Types of ETFs and How to Forex or stock trading Them How A Company Share Structure Impacts Stock Price Understanding Secondary Offerings Pair Trading — What You Should Know About This Strategy For Forex or stock trading Risk Understanding Time Decay — What You Should Know Why Serious Day Traders Need A Specialized Broker How Dividends Affect Stock Prices — A Deeper Look Economic Factors That Can Impact the Stock Market. Categories Chart Patterns Day Trading Day Trading Starter Guide Fundamental Analysis Level 2 Strategies Market Recaps Options Trading Short Selling SpeedTrader Updates Stock Brokers Stock Market Swing Trading Technical Analysis Technical Indicators Trading Platforms Trading Psychology Trading Strategy Trading Tips Webinars.

Trading Trendlines \u0026 Channels In Forex \u0026 Stock Market (Price Action Strategies)

, time: 11:31Forex Trading vs. Stock Trading: What's the Difference?

27/05/ · Forex vs. Stock Trading: which should you trade? The answer to this question completely depends on your goals as a trader, your trading style, and how much risk you can take. If you talk about the forex market, it offers you far more leverage and fewer regulations than stock trading 08/07/ · Forex trading is generally less regulated than stock trading, and forex traders have access to much more leverage than stock traders. Forex trading uses pairs, so the trade depends on the performance of two economies, as opposed to trading a single stock. Currencies are more liquid than stocks, they trade at all hours of the day, and large orders have less impact on currency pairings than they do on stock blogger.comted Reading Time: 8 mins 10/11/ · Should You Choose Forex or Stocks For Day Trading? The answer is obvious, you should pick Forex because it is a lot more advantageous for a short-term oriented day trader Estimated Reading Time: 5 mins

No comments:

Post a Comment