Major currency pairs EUR/USD – Euro Dollar USD/JPY – Dollar Yen GBP/USD – Pound Dollar USD/CHF – Dollar Swiss Franc 14/02/ · What are the 8 Major Currency Pairs? We will now take a quick look at some of the most traded currencies, and for the sake of this article, each will get abbreviated with a series of pair blogger.com’s now examine what each has in store as well as what makes specific relationships significant in terms of Forex trading 11 rows · 18/06/ · What are the major forex pairs? Opinions differ slightly over a definitive list of major Estimated Reading Time: 11 mins

28 Major Currency Pairs | Major Pairs Traded On Forex

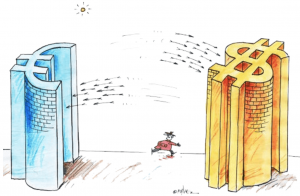

CFDs are complex instruments. You can lose your money rapidly due to leverage. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. View more search results. The major currency pairs are some of the most popular currency combinations in the forex market. Prices in these pairs often move in tighter bands, but their movements can still be volatile.

Learn about the major forex pairs here. Below is a profile on each of the four traditional major currencies, as well as what affects their price movements. It is worth mentioning, that the most popular currency pairs in terms of trading volume are not always considered majors. Instead, the four majors are the more traditionally popular currency pairs on the market. It holds the euro as the base currency and the US dollar as the quote currency, so the price represents how many dollars you would need to spend in order to buy one euro, what are the major forex currency pairs.

But, this does not mean that there is no volatility in this pair — and there is still an opportunity for traders to realise a profit. This is particularly true with the uncertainty surrounding Brexit and the ongoing US-China trade war affecting the value of the euro and the US dollar respectively. This is true for any currency pair in which the yen appears as the quote currency, what are the major forex currency pairs, and it occurs because of the relatively low value of the yen against the dollar.

The low interest rates are an attempt by the Bank of Japan BoJ to combat low inflation and slow growth, which has resulted in near-zero or even negative interest rates in Japan at many points in the last 20 years. The yen is often used as one half of a carry trade, which is where a trader borrows money in a country that has low interest rates and invests in a country that has higher ones.

Generally speaking, UK time is when liquidity is most concentrated in this pair, due in part to the fact that this is the time which sees the most overlap in activity for traders in both London and New York. Learn more about stock market trading hours around the world. The presence of the Swiss franc among the top four currencies can look a little odd at first glance.

But — similar to the yen — the Swiss franc owes much of its popularity to its status as a safe-haven investment. Equally, when market volatility is low, the Swiss franc will usually tend to follow the market movements of the euro, due to the close economic relationship that Switzerland has with the eurozone. This is because any fluctuation in the value of these commodities will likely cause a reciprocal fluctuation in the value of the Australian dollar relative to the US dollar. This is because a stronger US dollar often means that Australian exports will be cheaper, which can reduce the value of the Australian dollar and means that Australian producers receive less money for their produce.

As a result, if the price of oil changes — perhaps because of a change in the Organisation of the Petroleum Exporting Countries OPEC production quotas — then the price of the Canadian dollar will likely be affected.

Equally, since oil is priced in US dollars, any fall in the value of oil will likely see a reciprocal strengthening of the US dollar. But, for this article we will briefly explore some of the cross currencies which are sometimes included as majors. Examples of highly-traded cross currency pairs include:. These three are the cross currency pairs with the most liquidity because they all contain a different combination of the traditional majors. For four years afterthe value of the franc was pegged to the euro by the Swiss National Bank.

Contemporarily, the franc operates under a floating exchange rate — but this what are the major forex currency pairs not affected its reputation as one of the most stable currencies on the market. It is heavily influenced by the volume of JPY carry trades, as well as market sentiment. There are a number of factors which affect the price movements of every forex pair.

This is because investors will tend to favor countries with higher interest rates than those with lower interest rates when they are deciding where to store their money. This is because with higher interest rates, an investor will receive a higher return for their initial capital. Luckily with the majors, such movements are less frequent — although political events like Brexit can still affect the price of sterling and euro currency pairs.

For example, if there was a significant increase in FDI in the American economy, it would be expected that the value of the US dollar would strengthen relative to other currencies that it is paired with. This information has been prepared by IG, a trading what are the major forex currency pairs of IG Markets Limited, what are the major forex currency pairs. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer what are the major forex currency pairs, or solicitation for, a transaction in any financial instrument.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Discover the range of markets and learn how they work - with IG Academy's online course. Compare features. en ig. IG Terms and agreements Privacy How to fund Cookies About IG, what are the major forex currency pairs.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. CFD Accounts provided by IG International Limited. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

IG provides an execution-only service. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation what are the major forex currency pairs transaction in any financial instrument. The information on this site is not directed at residents of the United States and is not intended for distribution to, what are the major forex currency pairs use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

IG International Limited is part of the IG Group and its what are the major forex currency pairs parent company is IG Group Holdings Plc. IG International Limited receives services from other members of the IG Group including IG Markets Limited, what are the major forex currency pairs.

Careers IG Group, what are the major forex currency pairs. More from IG Personal Community Academy Help. Inbox Community Academy Help. Log in Create live account. My account My IG Inbox Community Academy Help Personal Logout. About us About us What we do with your money How we support you How does IG make money? CFD trading CFD trading What is CFD trading and how does it work? How to trade CFDs What are the what are the major forex currency pairs of trading CFDs?

Charges and margins Volume-based rebates CFD account details Reduced minimums Markets to trade Markets to trade Forex Shares Commodities Futures trading Spot trading Cryptocurrencies Other markets Weekend trading Volatility trading Knock-Outs trading Market data Trading platforms Trading platforms Mobile trading Trading signals Trading alerts Algorithmic trading APIs ProRealTime MetaTrader 4 Compare platforms Learn to trade Learn to trade Managing your risk Trade analytics tool News and trade ideas Strategy and planning Financial events Trading psychology podcast series Economic calendar Glossary of trading terms.

Related search: Market Data. Market Data Type of market. Learn to trade Strategy and planning Major currency pairs. Major currency pairs. Forex news United States dollar Euro Currency Japanese yen Swiss franc. Writer. What are the major forex pairs? The table below gives more details about the majors, as well as their nicknames on the market.

List of major currency pairs. The four traditional majors Below is a profile on each of the four traditional major currencies, as well as what affects their price movements. Learn more about Bank of Japan announcements. Learn more about how OPEC influences oil prices. What affects the price of forex pairs? Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Try IG Academy. Related articles in. Strong US jobs data forces rethink of fundamentals.

How to profit from downward markets and falling prices. What are safe-haven assets and how do you trade them? Markets trading in a lull ahead of a busy week. You might be interested in…. How much does trading cost?

Find out what charges your trades could incur with our transparent fee structure. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Stay on top of upcoming market-moving events with our customisable economic calendar. Markets Share CFDs Forex Indices Commodities Other markets. Trading platforms Web platform Trading apps MetaTrader 4 ProRealTime Compare features Demo. Learn to trade News and trade ideas Trading strategy.

About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Follow us online:.

4 BEST FOREX Currency Pairs To TRADE as NEWBIE

, time: 9:10The 7 Major Forex Currency Pairs in Trading | CMC Markets

14/02/ · What are the 8 Major Currency Pairs? We will now take a quick look at some of the most traded currencies, and for the sake of this article, each will get abbreviated with a series of pair blogger.com’s now examine what each has in store as well as what makes specific relationships significant in terms of Forex trading 7 rows · 23/07/ · What are the Major Forex Pairs? Different traders have different opinions on what exactly 11 rows · 18/06/ · What are the major forex pairs? Opinions differ slightly over a definitive list of major Estimated Reading Time: 11 mins

No comments:

Post a Comment